AI-Generated Image

TMTPOST -- With mounting competition, rising supply chain expenses and higher client acquisition costs, many Chinese cross-border merchants are finding themselves at a crossroads.

Traditional methods of scaling through paid online traffic and marketing strategies are no longer delivering the results they once did, and business owners like Sun Jing, who specializes in exporting daily consumer goods, are feeling the pinch. "The marketing strategy that worked last year is no longer effective. Sales growth remains slow," Sun told AsianFin.

Sun is not alone. Lily, a seasoned cross-border entrepreneur, observed a similar trend. "Since last year, we've seen a significant slowdown in our ability to attract customers," she said. These challenges reflect a shift in the way cross-border businesses need to approach growth.

Historically, many cross-border businesses in China relied on successful case studies and return on investment (ROI) to justify their heavy reliance on paid ads across platforms like Google, Facebook, and e-commerce sites.

But as the market has evolved, businesses are increasingly finding that relying on traffic-driven strategies has its limits. Rising costs of customer acquisition combined with fierce competition are pushing merchants to reconsider their approach. The need to foster long-term relationships with customers and build a strong brand has never been more urgent.

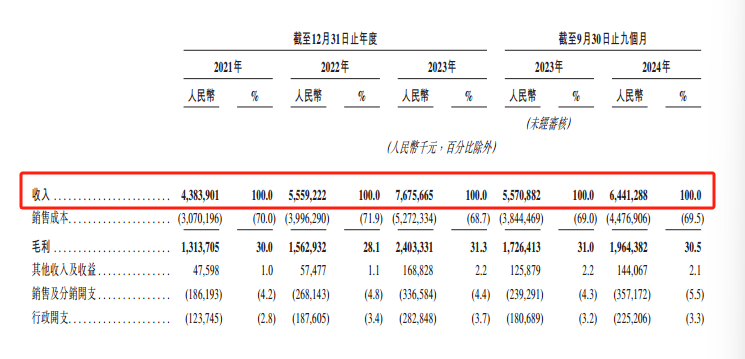

47% of cross-border merchants reported a revenue decline in 2024, a sharp increase from the 25% of merchants who saw a decrease in 2023, according to the "2024 Cross-border E-commerce Industry Blue Book."

As the challenges of market saturation and higher acquisition costs become more pronounced, merchants are searching for the next growth lever. The question on everyone’s mind: after exhausting the benefits of supply chain and traffic strategies, where can growth still be found?

For over a decade, China’s cross-border e-commerce has experienced exponential growth. Between 2016 and 2021, the industry enjoyed a compound annual growth rate (CAGR) exceeding 15%, driven by the country's low-cost supply chains, a vast pool of engineers, and untapped international markets. The cost advantages of China’s supply chain were a powerful magnet for merchants looking to enter global markets.

However, these advantages are now beginning to fade. The "blue ocean" of cross-border e-commerce has quickly turned into a competitive "red ocean." The influx of competitors has led to price wars and squeezed profit margins for all involved. Product differentiation has become harder to achieve, as many businesses are relying on the same supply chains and selling similar products.

In the past, the ability to offer competitively priced products was a major advantage. For example, a customized curtain for a U.S. home could cost around $30,000, while Chinese manufacturers could produce the same product for $15,000. But as more competitors flood the market with similar offerings, the only point of differentiation has become price, which is unsustainable in the long term.

As of now, there are over 120,000 Chinese cross-border e-commerce businesses, and more than 30,000 overseas trademarks have been registered. "There are always competitors willing to accept lower profit margins, and we are forced to lower prices as well. And with platforms like Amazon introducing price comparison systems, it's even harder," Sun Jing explained.

Moreover, the cost advantages that were once enjoyed in international supply chains are now dwindling. Businesses have to factor in rising costs associated with freight, storage, and returns when calculating profit margins. Changes in foreign policies, exchange rate fluctuations, and rising oil prices further compound the pressures on businesses.

For example, warehouse rental costs in Guadalajara, Mexico, increased by $0.80 per square meter in 2024, adding significant costs to businesses without the volume to dilute these expenses.

Lastly, the days of inexpensive or even free traffic are gone. In the past, entrepreneurs could generate traffic through SEO techniques to drive sales on platforms like Amazon. However, today, the cost of acquiring traffic is prohibitively high.

Between 2020 and 2021, for instance, the cost of Google Ads doubled, while Facebook’s advertising costs tripled. In such an environment, it is increasingly difficult for businesses to acquire customers at a cost that allows them to be profitable.

Branding, the Inevitable Choice

After facing intense competition and market saturation in 2024, an increasing number of cross-border businesses are shifting their focus from rapid growth to building long-term competitive advantages. Product quality, brand strength, and channel power have emerged as the key drivers of success, with brand strength taking center stage.

A strong brand does more than elevate a product’s value—it also allows companies to justify premium pricing and serve as a powerful endorsement for expansion into new markets. Brands that manage to enter consumers' line of sight early often have a competitive edge in crowded markets.

Building a strong brand is seen as the critical next step for cross-border merchants. Sun Siyuan, the CEO of BrandPal, told AsianFin, "The future is about brand building. No matter how the political or economic environment changes, there will always be market opportunities."

One exemplary case of using brand strength to achieve growth is seen in the global expansion of Chinese "trend toy" IPs. These IPs have gained significant popularity abroad, especially as they appeal to younger audiences. Monetizing these IPs is often achieved by accumulating brand followers and increasing user engagement, which requires a robust brand.

Historically, China has been known as the "world’s toy factory," producing about 70% of the world’s toys. However, most of these products were manufactured with low added value, while brands like Sanrio, Bandai, and Lego were the ones recognized by global consumers. Now, Chinese brands like Pop Mart, Miniso, and 52Toys are taking the lead, not only gaining recognition in international markets but also experiencing substantial growth and profitability.

Take, for instance, a Barbie doll that retails for $9.90 in the U.S. For manufacturers in China’s Pearl River Delta, the profit margin might be just $0.35 per unit. However, with brand backing, the same doll can be sold at a much higher price, with profits sometimes exceeding ten times the original margin. Industry insiders have revealed that toy stores that sell their own branded toys can see a profit margin of 40-50%, compared to just 15% for generic products.

Social media has played a critical role in the success of these brands. Pop Mart, for example, has leveraged local influencers (KOLs) to promote their products through in-store visits, unboxings, and product reviews. This has generated significant consumer interest. In 2024, Pop Mart’s TikTok account in Thailand hosted 50 live streams and released 15 new videos, attracting 116,000 new followers.

Aside from Pop Mart, other brands like SKINTIFIC and Y.O.U have successfully built brand equity through online platforms like Shopee and TikTok. By attracting younger, tech-savvy consumers, these brands have gradually expanded into offline retail channels across Southeast Asia.

This approach demonstrates that a strong brand can tap into new consumer segments, enabling businesses to command higher prices and drive significant revenue growth.

While online retail has boomed in recent years, offline channels still account for the majority of retail sales globally, particularly in markets like the U.S. and Europe. Despite this, cross-border businesses face considerable challenges when trying to enter offline retail spaces.

The sales head of Songmics Home, a cross-border e-commerce company, explained that having an established online brand reputation is crucial for entering local offline channels. According to the company’s general manager in Germany, the process of accumulating brand assets online helped facilitate better collaboration with local retail partners.

Building a brand is essential for cross-border businesses aiming to succeed in today’s competitive landscape. While the transition to brand-building may be challenging, the benefits in terms of customer loyalty, pricing power, and differentiation are undeniable.

Social media platforms like TikTok are playing an increasingly vital role in helping businesses establish and measure their brand presence, offering a new pathway for growth in the cross-border e-commerce space.

As the traditional advantages of supply chains and traffic dwindle, it’s clear that the next frontier for cross-border merchants lies in brand-building. This shift marks the beginning of a new growth cycle—one focused on long-term sustainability and market differentiation.

京公网安备 11011402013531号

京公网安备 11011402013531号